will capital gains tax increase in 2021

Ad If youre one of the millions of Americans who invested in stocks. Could capital gains taxes increase in 2021.

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

The proposal would increase the maximum stated capital gain rate from 20 to 25.

. Last years tax gains. Discover Helpful Information and Resources on Taxes From AARP. 2021 Long-Term Capital Gains Tax Rate Income Thresholds.

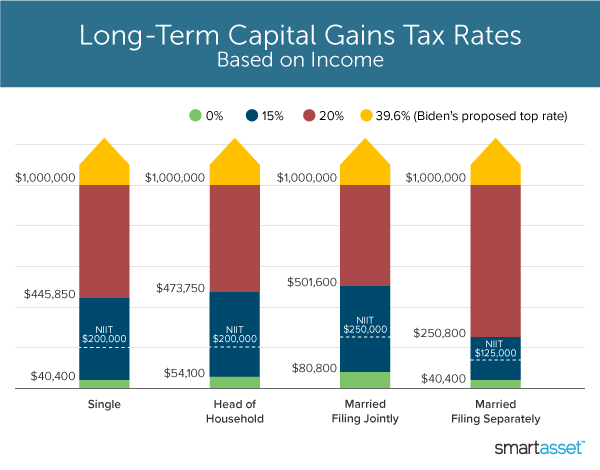

Specifically the current top capital. And CapGainsValet predicts 2021 will see more than double the historical average of funds making distributions of more than 10. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021.

Some information may no longer be current. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

3 Dated Rules of Thumb Retirees Should Think. Published January 12 2021Updated February 9 2021. The current tax preference for capital gains costs upwards of 15 billion annually.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. Its time to increase taxes on capital gains.

Ad Compare Your 2022 Tax Bracket vs. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed - as of the Budget on 27 October 2021 - this was immediately increased to 60 days. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate.

Taxable Income Single Taxable Income Married Filing Separate Taxable Income Head of Household Taxable Income Married Filing Jointly 0. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Note that short-term capital gains taxes are even higher.

This article was published more than 1 year ago. IRS announces interest rates will increase. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

As proposed the rate hike is already in effect for sales after April 28 2021. The proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Capital Gains Tax Rate.

Your 2021 Tax Bracket to See Whats Been Adjusted. Those with less income dont pay any taxes. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall. Your total withholding and timely estimated payments for 2022 are at least 100 of your total 2021 tax liability 110 if 2021 AGI was 150k. Under Bidens proposal all taxpayers making more than 1 million in long-term capital gains would have to pay the 396 rate in addition to the 38 NIIT.

But in 2020 with very good market performance and continued mutual fund outflows 2021 is expected to be much more significant. Posted on January 7 2021 by Michael Smart. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

For 2021 the top tax bracket includes the following taxpayers. Add state taxes and you may be well over 50. Makes a capital gains tax increase more likely.

All Major Categories Covered. If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year. Thats 50 more funds predicted to make large taxable distributions of more than 10.

We will look at the tax rates from 2021 to 2022 and hope that these will inspire us to fathom the projections for the next year as well. This means that high-income investors could have a tax rate of up to 396 on short-term capital gains. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times Capital Gains Taxes Explained Short Term Capital Gains Vs. And do some basic due diligence and find out youre going to owe -300k in capital gains tax on it theyll want to know if youve paid that tax yet. Single filers with income over 523600.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe. Currently the capital gains rate is 20 for single taxpayers with income. Weve got all the 2021 and 2022 capital gains tax rates in one.

The 238 rate may go to 434 an 82 increase. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest Americans.

The effective date for this increase would be September 13 2021. It also includes income thresholds for Bidens top rate proposal and the 38 NIIT. Select Popular Legal Forms Packages of Any Category.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as.

To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased.

What S In Biden S Capital Gains Tax Plan Smartasset

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What You Need To Know About Capital Gains Tax

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax What Is It When Do You Pay It

What You Need To Know About Capital Gains Tax

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)